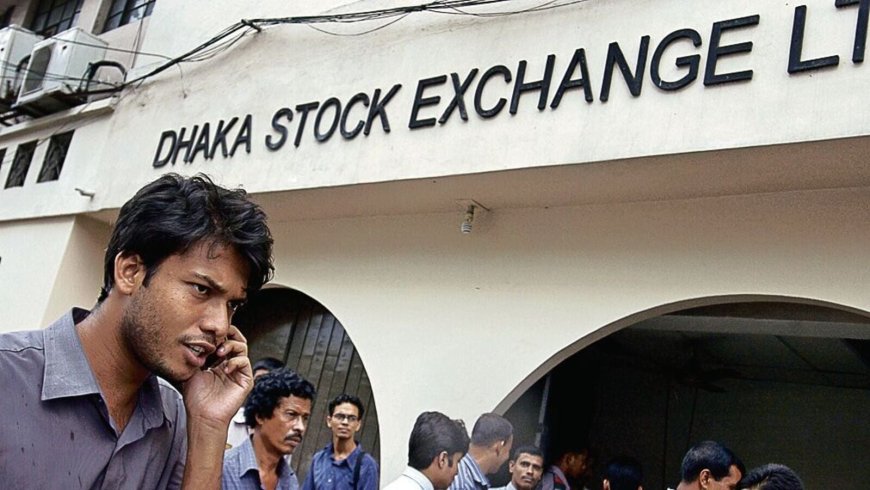

Trump tariffs: DSE30 index ends higher as Bangladesh stock market shrugs off 35% tariff by US President

DSE30 ends higher despite Donald Trump's tariff threat on Bangladeshi imports. Market sentiment remains positive amid macro stability and export diversification.

Dhaka, July 8, 2025 — In a surprising show of resilience, the Dhaka Stock Exchange’s DSE30 index closed higher on Tuesday, brushing off investor worries following former U.S. President Donald Trump’s announcement of a sweeping 35% tariff on imports from select countries, including Bangladesh. The development, which many feared would jolt the export-heavy Bangladeshi economy, had only a modest effect on market sentiment, with key indices recovering after a muted start.

DSE30 Climbs Amid Trade Headwinds

The benchmark DSE30 index rose by 0.63%, gaining 15.21 points to settle at 2,438.87. The broader DSEX index also edged up by 0.48% to close at 6,230.52, while the DS30 and DSES indices posted gains of 0.63% and 0.39%, respectively.

Market turnover reached BDT 8.73 billion, up from BDT 7.95 billion in the previous session, indicating renewed investor confidence despite global trade uncertainties.

Trump's Tariff Move and Its Implications

Former U.S. President and Republican frontrunner Donald Trump recently reiterated his commitment to impose a 35% blanket tariff on imports from countries he deems "unfair trading partners," should he return to office in 2025. Bangladesh, a key player in the global textile and apparel supply chain, is among the countries likely to be affected by this policy stance.

The United States is Bangladesh’s single largest export destination, accounting for over 17% of its total garment exports. Analysts had earlier predicted that such protectionist measures could hurt Bangladesh’s export earnings, widen the current account deficit, and increase pressure on the taka.

Market Reacts Calmly: Why the Panic Didn’t Last

Despite these headwinds, the local stock market remained buoyant. Textile and pharmaceutical stocks led the rally, driven by bargain hunting and speculation that any U.S. tariff might be softened through bilateral negotiations.

“The market seems to have priced in the risk of Trump returning to power and imposing tariffs. Today’s rebound shows that investors are betting on Bangladesh’s long-term trade competitiveness and diversification strategy,” said Rafiqul Islam, Senior Analyst at LankaBangla Securities.

The government’s recent moves to strengthen trade ties with the European Union and expand exports to China, India, and the Middle East have also boosted confidence that Bangladesh is not overly reliant on the U.S. market.

Sector-Wise Performance

-

Textiles: Shares of major RMG exporters like Square Textiles, Envoy Textiles, and DBL Group gained between 1.5% and 3.2%, as investors viewed the selloff as overdone.

-

Pharmaceuticals: Blue-chip stocks like Beximco Pharma and Renata rose 2.1% and 1.7%, respectively, amid hopes of increased domestic demand and robust Q2 earnings.

-

Banking and Financials: Mixed performance, with BRAC Bank inching up 0.5% while Dutch-Bangla Bank dipped 0.3% on profit booking.

-

Power and Energy: Steady, as Summit Power and United Power saw marginal gains on expectations of consistent power demand during the monsoon season.

Currency and Macro Indicators Remain Stable

The Bangladeshi taka held steady at BDT 117.3 per U.S. dollar in interbank markets, supported by remittance inflows and cautious dollar sales by the central bank. Foreign exchange reserves stood at USD 25.4 billion, providing sufficient import cover for over five months.

Inflation eased to 8.2% in June from 8.8% in May, offering further comfort to investors that macroeconomic fundamentals are gradually stabilizing. The central bank’s recent signal to pause further rate hikes has also encouraged equity investments.

Analyst Outlook: Short-Term Volatility, Long-Term Opportunity

While concerns over Trump’s potential return to the White House and tariff enforcement remain, analysts believe the Bangladeshi market has entered a consolidation phase.

“We expect short-term volatility ahead of the U.S. elections. However, Bangladesh’s competitive edge in low-cost garment production and its ability to pivot to alternative markets will shield it from prolonged shocks,” said Tahmidur Rahman, Head of Research at UCB Capital.

“Investors should look at fundamentally strong export-oriented companies that are working on vertical integration and product diversification,” he added.

Government Response and Trade Strategy

The Ministry of Commerce responded to the tariff threat by stating that Bangladesh will initiate discussions with U.S. trade representatives and the WTO if any discriminatory tariffs are enforced.

A senior official also confirmed that the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) is preparing a position paper outlining the negative impact such tariffs would have on workers and bilateral trade relations.

Despite the geopolitical overhang, the DSE30’s positive finish reflects the growing maturity of the Bangladeshi capital market and the belief among investors that the country’s export sector has the resilience to navigate policy shocks. While vigilance remains key, the market’s bounce-back suggests that panic selling is giving way to cautious optimism.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0