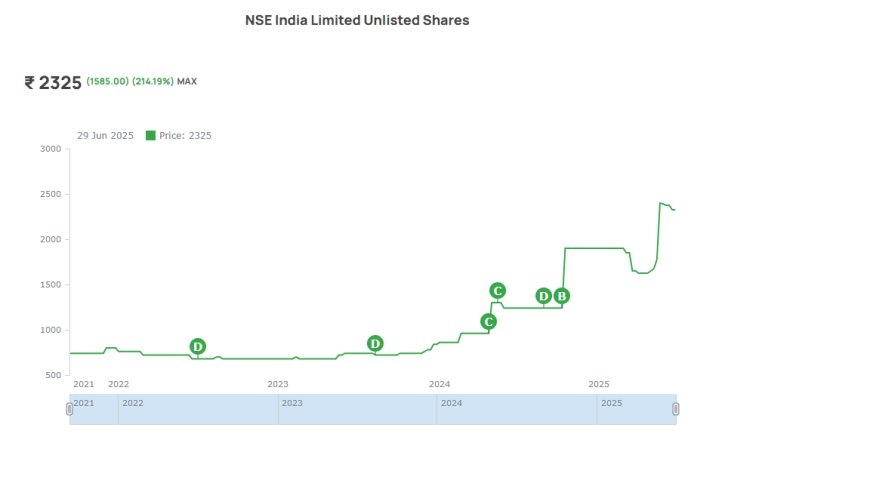

LONG TERN INVESTMENT IDEA NATIONAL STOCK EXCHANGE (UNLISTED) BUY around Rs.2150 TARGET Rs.8800. ACCUMULATE ON LOWER PRICES.

LONG TERN INVESTMENT IDEA

NATIONAL STOCK EXCHANGE (UNLISTED)

BUY around Rs.2150 TARGET Rs.8800. ACCUMULATE ON LOWER PRICES.

The National Stock Exchange of India (NSE) is India's leading stock exchange, providing a comprehensive trading and investment platform. Established in 1992, NSE operates as a market infrastructure institution with headquarters in Mumbai. It offers advanced, automated electronic trading across various asset classes, including equities, derivatives, and fixed-income securities.

National Stock Exchange of India Ltd (NSE) is a market infrastructure institution that operates a comprehensive trading and investment platform. It primarily carries out the implementation of electronic or screen-based trading across various asset classes. The company offers a wide range of products and services, including equities, derivatives, and fixed-income securities. The entity also provides securities lending and borrowing schemes, equity and currency derivatives, debt market, institutional placement programs, sovereign gold bonds schemes and corporate bonds. It operates through its branch offices in Ahmedabad, Chennai, New Delhi, Hyderabad, Kolkata, and Mumbai. NSE is headquartered in Mumbai, Maharashtra, India.

Popular Indices: NIFTY 50 and Other Indices

The NIFTY 50 is the NSE’s benchmark index, tracking 50 major Indian stocks. It reflects market trends and is widely used by investors. The another widely traded index of NSE is BankNifty which is also most popular because of its high liquidity and volatility.

NSE also offers:

· NIFTY Next 50: Tracks the next 50 large-cap stocks after NIFTY 50.

· NIFTY 500: Covers 500 companies, providing a broader market view.

· NIFTY Midcap 150 & NIFTY Smallcap 250: Represent mid and small-cap stocks.

· NIFTY MidSmallcap 400: Tracks a mix of mid and small-cap stocks.

NSE continues to be world’s largest derivatives exchange for 6th straight year

Comparison with BSE (Listed)

Profit & Loss Summary for FY 2024

|

Profit & Loss (In Rs CR) – FY 2024 |

NSE |

BSE |

|

Revenue |

16,433 |

1618 |

|

Operating EBITDA |

9,870 |

400 |

|

PBT |

11,184 |

956.6 |

|

PAT |

8,306 |

771.6 |

|

EPS |

167.79 |

56.66 |

Balance Sheet for FY 2024

|

Profit & Loss (In Rs CR) – FY 2024 |

NSE |

BSE |

|

Revenue |

16,433 |

1618 |

|

Operating EBITDA |

9,870 |

400 |

|

PBT |

11,184 |

956.6 |

|

PAT |

8,306 |

771.6 |

|

EPS |

167.79 |

56.66 |

Cash Flow comparison FY 2024

|

Particulars (As of March 24) |

NSE |

BSE |

|

Profit Before Tax |

11,104.70 |

771.6 |

|

Net Cash Flow from Operating Activity |

29,744.30 |

2842 |

|

Net Cash Used in Investing Activity |

-8,336.31 |

-1064.5 |

|

Net Cash Used in Financing Activity |

-3,993.69 |

-149 |

|

Net Inc/Dec In Cash and Cash Equivalent |

17,414.30 |

1628.5 |

|

Cash and Cash Equivalent – Beginning of the Year |

5,974.65 |

453 |

As we can see from the data provided above, NSE has more trading volume than BSE, indicating that many stock buyers and sellers are available regarding NSE unlisted shares. In addition, NSE’s greater liquidity compared to BSE makes it a better choice. Greater liquidity indicates easier trading, ultimately providing several opportunities to convert shares into money. If you are a retail investor wishing to trade in derivatives, NSE would be a preferred alternative since NSE has a monopoly in the derivative contract segment, and the trading numbers of NSE Nifty are high due to its better liquidity.

NSE stands out 10 times bigger than that of BSE in terms of Revenue (16,433 vs 1,618 Cr); PBT (11,184 vs 956.60 Cr); and PAT (8,306 vs 771.60 Cr). NSE is dominating with more than 90% market share in all categories. Compared to BSE, its revenue is 10 times more than BSE for the last four years. In 2024 NSE’s EPS (Equity Per Share) is 167 per share in the financial year 2024, which is 3 times more than the EPS of BSE.

· Trading Volume and Liquidity

· NSE has a higher trading volume, making it ideal for traders looking for quick transactions and minimal price fluctuations.

· BSE has lower liquidity may lead to slightly wider bid-ask spreads, affecting trade execution speed.

· Stock Availability

· Most stocks are listed on both NSE and BSE, giving investors the flexibility to trade on either exchange.

· Some stocks, however, may be exclusively listed on one exchange, making the choice straightforward.

· Investment Strategy

· Day traders and short-term investors prefer NSE due to its faster trade execution and higher liquidity.

· Long-term investors may find BSE suitable for its diverse stock listings, including small and mid-cap companies.

· Technology and Efficiency

· NSE offers an advanced trading platform with high-speed execution, making it a preferred choice for active traders.

· BSE has also upgraded its technology with BOLT (BSE Online Trading), but remains slightly behind in speed.

· Index Preference

· If you track the Nifty 50, NSE is the natural choice.

· If you follow the Sensex, you may prefer trading on the BSE.

· Technology: NSE has a more advanced and reliable technology infrastructure than BSE, allowing faster and more efficient trading.

· Products: NSE offers a wider range of financial products, including derivatives, which attract more investors and traders.

· Transparency: NSE strongly focuses on transparency and disclosure, which instils investor confidence and helps prevent fraudulent activities.

· Liquidity: NSE is known for higher liquidity levels, meaning there is more trading activity and higher trading volumes, making it easier for investors to buy and sell securities.

5. Efficiency: NSE has introduced several measures to increase efficiency, such as market-wide circuit breakers, which help stabilise the market during times of volatility.

The BSE stock is having FV of Rs.2 and NSE having Re.1. Considering the value proportion, justified price could be Rs.8800.

|

Disclaimer : This report is not an investment recommendation. All the information made available here is generally provided to serve as an example only, without obligation and without specific recommendations for action. It does not constitute and cannot replace investment advice. All opinions, news, investigations, analyses, prices or other information or statements offered by We are provided in the form of general remarks and comments. They do not constitute investment advice. We assumes no liability for loss or damage, including, but not limited to, lost profits that may result directly or indirectly from the use or reliance on the abovementioned opinions, news, investigations, analyses, prices or other information offered by the company. In this regard we also refer to our General Business Terms and Conditions. All the investment forms described here involve large financial risk. The past performance of a security, an industry, a sector, a market, a financial product, a trading strategy or the individual trade does not guarantee any future results or returns. As an investor, you yourself bear the full responsibility for your individual investment decisions. Such decisions should be based on an assessment of your financial situation, your investment objectives, your risk tolerance and your liquidity need and should be discussed in advance with your personal financial advisor in case of doubt. Readers’ discretion is endorsed. We therefore recommend that you contact your personal financial advisor before carrying out specific transactions and investments. |

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0