Radhika Gupta Cautions Against ‘Influencer Advice’ on Unlisted Stocks: ‘Reality of Valuations and Financial Gravity’

Edelweiss CEO Radhika Gupta cautions retail investors against blindly following influencers promoting unlisted stocks. She warns that valuations must align with financial reality.

Mumbai, June 25, 2025 – In an increasingly digitized financial landscape where investment advice is often just a scroll away, Radhika Gupta, MD & CEO of Edelweiss Mutual Fund, has issued a pointed caution to retail investors about relying on social media influencers for guidance on unlisted stocks. Speaking at a recent industry event, Gupta emphasized the widening gap between the hype surrounding unlisted companies and their intrinsic valuations, describing the phenomenon as “divorced from the financial gravity of reality.”

Her remarks arrive at a time when a growing number of influencers on platforms like YouTube, Instagram, and X (formerly Twitter) are pushing pre-IPO opportunities and shares of startups yet to list, enticing young investors with the promise of astronomical returns. However, industry experts warn that the allure often masks critical risks that many novice investors fail to assess properly.

“Valuations Must Meet Gravity”: Gupta’s Core Message

“Just because something is not listed does not make it exclusive or safer,” Gupta said during a panel discussion on retail investing trends. “There is a certain financial gravity — profits, cash flow, business fundamentals — that even the most talked-about startup cannot escape. Eventually, valuations must meet reality.”

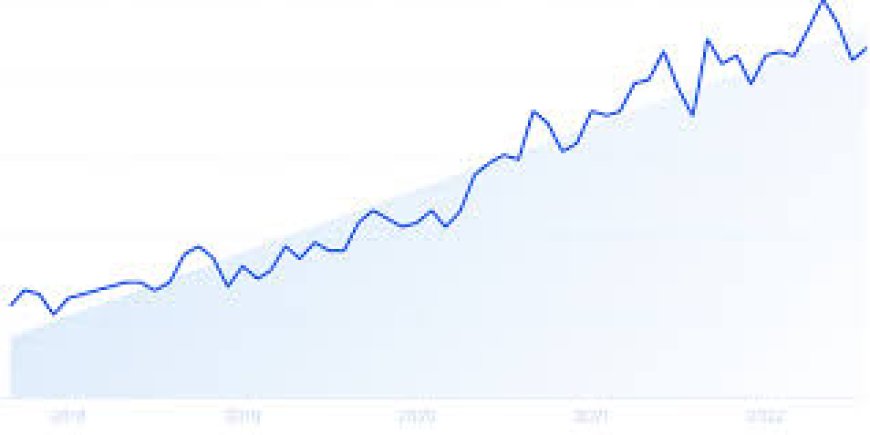

She elaborated that while democratization of investing is a positive trend, the increasing glamorization of unlisted equities without corresponding education on risks is problematic. Gupta pointed to the flood of interest in startup shares during the bull market of 2021–22, many of which have since seen steep corrections post-listing or are still struggling to turn a profit.

The Rise of “Finfluencers” and the Bubble Effect

The rise of “finfluencers” — a portmanteau of financial influencers — has created a parallel advisory ecosystem, often with limited regulatory oversight. While some content creators are qualified professionals offering genuine education, others promote speculative strategies or highlight hand-picked success stories without sufficient context or disclaimers.

“The danger arises when followers perceive influencers as substitutes for certified advisors,” noted Anshul Mehra, a SEBI-registered investment advisor. “Unlisted stocks are inherently illiquid, opaque, and often lack verifiable data. Retail investors must question how influencers get access to such deals and whether the promoted companies have a track record to justify their valuations.”

Recent Cases Fuel Caution

The market has seen recent examples where investors lured by pre-IPO buzz ended up with deep losses. Companies like GoMechanic, once highly sought-after in the unlisted space, faced corporate governance concerns that led to valuation markdowns. Similarly, many investors who bought shares of online pharmacy startups ahead of listing discovered later that revenue projections were overly optimistic.

According to data from UnlistedKart, a private market analytics platform, several highly traded unlisted stocks have dropped 30–50% in estimated market value in the last year, driven by tighter liquidity, startup cost pressures, and changing investor sentiment.

SEBI’s Growing Scrutiny of the Unlisted Ecosystem

The Securities and Exchange Board of India (SEBI) has started paying closer attention to the unlisted equity space. Earlier this year, the regulator proposed frameworks for oversight on the private share market, including more transparency around pricing, seller disclosures, and investor suitability checks.

A senior SEBI official, speaking on condition of anonymity, noted, “The regulator is aware that financial influencers are often the first point of contact for Gen-Z investors. We are evaluating guidelines to ensure that any advice related to unlisted shares is traceable and responsible.”

Institutional Players Step Back Amid Valuation Concerns

Several institutional investors, including private equity and venture capital firms, are also reevaluating their exposure to growth-stage startups. A recent Bain & Co. report revealed that funding in Indian startups declined by over 35% in FY25, with investors citing concerns around inflated pre-money valuations and insufficient exits.

“Valuation multiples in the unlisted market have to adjust in line with public markets,” said Sonal Shah, Partner at a leading VC firm. “We’re already seeing repricing in secondary transactions. Investors who bought into the hype without understanding unit economics are stuck in illiquid positions.”

Investor Outlook: Proceed with Caution

For retail investors, the key takeaway is to tread cautiously. Unlisted equities can play a role in a diversified, long-term portfolio — but only when backed by thorough due diligence, credible data, and a clear understanding of liquidity constraints.

Radhika Gupta’s warning is timely, reminding investors that financial literacy must grow alongside financial access. The rise of digital platforms has unlocked new opportunities, but also new risks. Investing should be driven by facts, not FOMO.

Investor Tip:

Before buying unlisted stocks:

Ask for audited financials and business model clarity.

Check promoter history and past capital raises.

Evaluate exit timelines — can the stock be sold if needed?

Understand the legal and tax implications.

Prefer platforms regulated by SEBI or RBI over informal deals on social media.

In an era where “influencer advice” travels faster than rational analysis, Radhika Gupta’s voice serves as an important counterweight. Her call for financial prudence over blind optimism highlights the need for retail investors to blend enthusiasm with caution — especially in high-risk areas like unlisted stocks.

As the market matures and more investors enter through digital channels, the responsibility lies not just with regulators or platforms, but with individuals to separate financial fact from fiction.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0