Currencies drop, stocks mixed with tariff deadline in sight, US data eyed

Global markets show mixed signals as currencies weaken and stocks fluctuate amid looming tariff deadlines and anticipated U.S. economic data. Investors brace for volatility.

Markets show caution amid renewed trade tension fears and macroeconomic data anticipation

Global financial markets remained on edge Tuesday as major currencies weakened and stock indices showed mixed performance, with investor sentiment dampened by an impending tariff deadline and closely watched U.S. economic data. Concerns over escalating protectionist policies and uncertainty surrounding the U.S. Federal Reserve’s next moves have kept traders on a tight leash.

Tariff Deadline Sparks Jitters

Investors are closely eyeing a looming tariff deadline that could potentially reignite trade tensions between the United States and some of its key trading partners, including China and the European Union. The proposed levies are part of a broader effort by the Biden administration to recalibrate trade dynamics and address concerns over intellectual property and manufacturing competitiveness.

“Markets are bracing for another round of tariff headlines that could disrupt fragile global supply chains,” said Emily Tan, Senior Currency Strategist at Global FX Research. “Currency markets are pricing in increased uncertainty, and that’s showing in the weakness of emerging market and Asian currencies.”

Currencies Slide Across the Board

The U.S. dollar gained strength as traders sought safety amid geopolitical and economic concerns, with the DXY Dollar Index rising 0.35% to 105.40. Meanwhile, the euro slipped 0.4% to $1.0812, and the Japanese yen weakened to 157.85 per dollar, inching closer to its 38-year low.

The British pound also edged down 0.3% to $1.2845, while emerging market currencies such as the Indian rupee and the Brazilian real posted sharp declines, reflecting capital outflows and investor caution.

“Global currencies are caught between the safe-haven appeal of the U.S. dollar and the fear of a slowdown in trade,” said Ankit Rao, Chief Market Economist at Axis Global. “Until we get clarity on the tariff policy and the Fed’s inflation stance, expect volatility to remain elevated.”

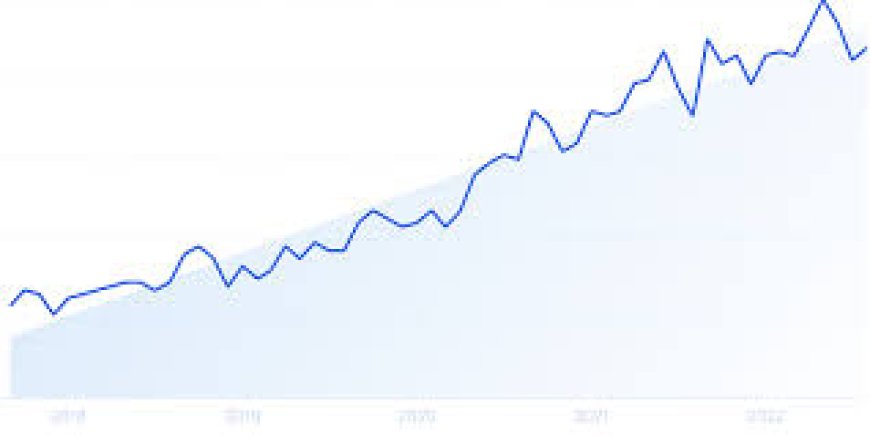

Stock Markets Show Divergence

Equity markets struggled to find direction, with Wall Street indexes trading flat to lower as investors awaited critical economic indicators later this week, including U.S. GDP figures and the Fed’s preferred inflation gauge—the Core PCE Index.

-

The S&P 500 was last seen trading near flat at 5,140.

-

The Dow Jones Industrial Average dipped 0.2% to 39,270.

-

The Nasdaq Composite rose marginally by 0.1% to 18,090.

Asian equities mirrored the nervous tone, with the Nikkei 225 falling 0.6% and the Hang Seng Index losing 0.8% amid broad-based selling. European bourses held steady, buoyed by earnings optimism but tempered by trade concerns.

“Equities are largely range-bound, caught between resilient earnings reports and macroeconomic uncertainty,” noted Laura Cheng, Equity Strategist at MorningView Securities. “Investors are hesitant to make bold bets ahead of key inflation data and potential tariff shocks.”

Focus Turns to U.S. Economic Data

Markets are keenly awaiting a slate of U.S. macroeconomic data, which could influence the Federal Reserve’s interest rate path. The second-quarter GDP growth estimate due Thursday and the Core PCE Price Index on Friday will be pivotal in shaping expectations.

Recent Fed commentary has emphasized the need for more evidence of inflation slowing before rate cuts can be considered. The central bank’s July meeting is expected to maintain a hawkish hold, with market participants split on whether a rate cut could materialize before December.

“Stronger-than-expected data would reinforce the Fed’s cautious stance and keep yields elevated, adding pressure on non-dollar assets,” said Gina Walsh, Senior Rates Analyst at Capital Horizons.

Commodities, Bonds Signal Defensive Positioning

Commodities reflected investor unease, with Brent crude easing 0.5% to $82.35 per barrel amid weaker demand forecasts. Gold prices, traditionally a safe-haven asset, rose 0.7% to $2,365 per ounce, reflecting defensive positioning.

Meanwhile, U.S. Treasury yields edged lower as investors rotated into bonds. The 10-year yield slipped to 4.17%, down from 4.24% earlier in the week, indicating a flight to safety ahead of the U.S. data release.

Investor Outlook: Volatility Ahead

With multiple risk factors converging—geopolitical trade friction, uncertainty over inflation and monetary policy, and weakening global growth momentum—investors are likely to remain cautious in the near term.

“Until the economic picture becomes clearer, expect a stop-start dynamic in both currency and equity markets,” said David Kim, Global Asset Allocation Head at Terra Investments. “Risk-on trades will be selective, and defensive strategies are likely to dominate portfolios for the next few weeks.”

Traders are advised to monitor key policy developments, tariff announcements, and the outcome of U.S. economic data releases closely. In this climate, staying diversified and hedged may prove crucial.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0