Healthcare Asset Recovery Market Analysis: Trends in Cost Optimization & Eco-Friendly Disposal

Explore the latest trends in the healthcare asset recovery market, emphasizing cost optimization, sustainable disposal, and the shift toward environmentally responsible healthcare practices.

Healthcare Asset Recovery Market Analysis: Trends in Cost Optimization and Environmentally Responsible Disposal Solutions

By ASJ Ventures | May 23, 2025

In a world where the healthcare sector is under constant financial and environmental scrutiny, one often overlooked area is experiencing a profound transformation: healthcare asset recovery. Once considered a mere logistical necessity, it is now emerging as a strategic lever for cost savings, sustainability, and operational agility.

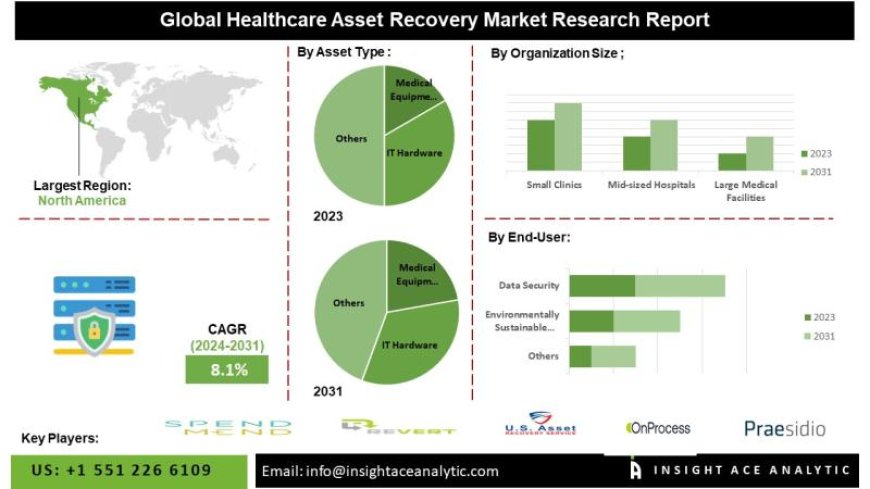

With the global healthcare asset recovery market projected to reach $6.4 billion by 2027, hospitals, clinics, and diagnostic centers are fast rethinking how they manage aging equipment, surplus medical supplies, and technological obsolescence. The game has shifted from disposal to responsible reallocation, resale, recycling, and refurbishment.

Let’s dive deep into the key trends shaping this niche yet crucial market segment in 2025 and beyond.

Market Growth Drivers: Why Asset Recovery Matters More Than Ever

1. Post-Pandemic Budget Realignment

COVID-19 left hospitals financially stretched. From critical equipment procurement to overtime staffing, most facilities faced budgetary blowouts. In the post-pandemic phase, healthcare institutions are aggressively cutting costs without compromising patient care. Asset recovery programs offer double-digit savings by recapturing value from idle or underutilized equipment.

2. Environmental, Social, and Governance (ESG) Pressure

Hospitals generate a disproportionate volume of waste, much of which is tied to equipment disposal. Regulators and stakeholders are demanding ESG compliance, and asset recovery offers a measurable way to reduce environmental impact—by diverting waste from landfills and promoting the reuse of functional assets.

3. Rise of the Circular Economy in Healthcare

The concept of circularity, where equipment is repurposed instead of discarded, is gaining traction. OEMs (Original Equipment Manufacturers) are now partnering with hospitals to refurbish used machines, turning waste into revenue and reducing raw material demand.

4. Technology Obsolescence & Lifecycle Management

In the age of AI-driven diagnostics and robotic surgeries, medical equipment cycles are shortening. High-cost assets such as MRI machines, infusion pumps, and diagnostic monitors are often replaced within 5–7 years. Strategic asset recovery ensures that outgoing equipment doesn’t go to waste.

Key Trends Defining the 2025 Asset Recovery Market

1. Integrated Asset Recovery Programs

Hospitals are no longer handling disposal internally. Instead, they’re partnering with specialized asset recovery firms to run end-to-end programs—including audits, deinstallation, transport, resale, and documentation. These firms use sophisticated inventory tracking software that ensures compliance with HIPAA and environmental laws.

2. Green Disposal Is Now Mandatory, Not Optional

Legislation in the EU, Canada, and several U.S. states mandates environmentally responsible disposal. This includes hazardous waste tracking, parts harvesting, and emissions management. Hospitals risk hefty fines for non-compliance, making green disposal not just ethical but economically sound.

3. AI and Data Analytics for Equipment Value Estimation

Artificial Intelligence now plays a vital role in evaluating the resale or reuse value of medical devices. Algorithms can assess depreciation, usage history, and market demand, enabling better decision-making about whether to sell, scrap, or refurbish.

4. OEM Buyback and Trade-In Programs

Major manufacturers such as GE Healthcare and Philips have expanded their buyback programs, creating a formal secondary market for used devices. Hospitals are now incorporating OEM partnerships into their CapEx and OpEx strategies for streamlined procurement and recovery cycles.

Regional Outlook

| Region | Market Share (2025) | Key Highlights |

|---|---|---|

| North America | 42% | Regulatory push, OEM partnerships, hospital network consolidation |

| Europe | 28% | Green compliance, e-waste legislation, NHS reforms |

| Asia-Pacific | 18% | Growth in secondary equipment market, rural hospital modernization |

| Latin America | 7% | Cost-driven recovery models, NGO-driven redistribution |

| Middle East/Africa | 5% | Donor-driven refurbishment programs |

Business Model Innovations

1. Revenue Sharing with Hospitals

New-age recovery firms are adopting shared revenue models, where the hospital receives a percentage of the resale value. This encourages inventory transparency and active participation in recovery programs.

2. Reverse Logistics Platforms

Just as e-commerce relies on reverse logistics for returns, the healthcare sector is now using tech-driven platforms to manage reverse supply chains, optimizing pick-up, storage, and resale or recycling of outdated inventory.

3. Blockchain for Compliance and Traceability

Blockchain is increasingly being used to track asset histories, ensuring tamper-proof records for audits, insurance, and valuation. This is crucial when transferring equipment across borders or reselling to smaller facilities.

Challenges to Overcome

1. Logistical Complexity

Many hospitals lack standardized processes for asset retirement. Multiple departments and varying equipment vendors make coordination a logistical nightmare without automation tools.

2. Data Privacy & HIPAA Compliance

Medical devices often store patient data. If not properly sanitized, reselling such equipment can lead to HIPAA violations. Strict data destruction protocols and third-party certification are critical.

3. Resistance to Change

Administrators may view asset recovery as non-core, leading to inconsistent implementation. A cultural shift is needed, where disposal and sustainability become board-level priorities.

Strategic Recommendations for Stakeholders

-

Hospitals: Appoint a dedicated sustainability officer or asset recovery manager to streamline operations.

-

Recovery Firms: Invest in AI and logistics tech to enhance service differentiation.

-

OEMs: Expand trade-in programs and offer incentives for green disposal.

-

Regulators: Provide clear guidelines and support schemes to accelerate adoption.

From Waste to Wealth, the Asset Recovery Revolution Has Begun

The healthcare asset recovery market is more than a back-office function—it’s becoming a strategic imperative. Hospitals that embrace it stand to gain not only financially but also reputationally in an era where environmental and operational excellence go hand in hand.

With evolving regulations, patient-centric innovations, and climate accountability on the rise, healthcare is slowly shifting from a linear model of consumption to a circular, sustainable model—where nothing is wasted, and everything is optimized.

The future of healthcare isn’t just about saving lives. It’s also about saving resources—and the asset recovery market is showing us how.

Would you like me to:

-

Generate a bulk upload CSV version for your CMS or WordPress?

-

Create a short-form Instagram caption to promote this article?

-

Turn this into a PDF or eBook-style format for lead generation?

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0