HDB Financial Services Share Price Extends Gains After Decent Listing: Should You Buy, Hold or Sell?

HDB Financial Services extends gains after a decent market debut. Find out if you should buy, hold, or sell the stock. Analyst views, market outlook, and valuation insights.

Introduction

HDB Financial Services, the non-banking financial company (NBFC) arm of HDFC Bank, made a noteworthy debut on the stock exchanges, marking a significant milestone in its corporate journey. Following a decent listing that was in line with market expectations, the stock has extended gains over the subsequent trading sessions, drawing interest from both retail and institutional investors. But with the initial euphoria settling and valuation concerns surfacing, the big question remains: should investors buy, hold, or sell HDB Financial Services shares?

Decent Market Debut Followed by Upward Momentum

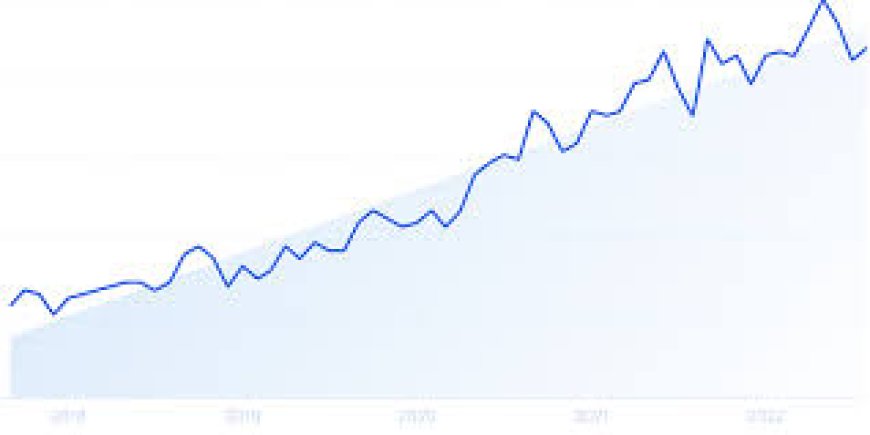

HDB Financial Services was listed as part of HDFC Bank's strategy to comply with Reserve Bank of India’s (RBI) directive to reduce its stake in non-core businesses. The stock listed on the BSE and NSE at ₹695, almost flat compared to the derived price of ₹695.36 from HDFC Bank's share price and the share exchange ratio (42:1). However, investor sentiment turned bullish shortly after, with the stock rallying over 8% in its first few sessions, breaching the ₹750 mark.

According to data from the exchanges, trading volumes have remained robust, reflecting continued interest in the NBFC space, especially given the company’s pedigree and financial performance.

What’s Driving the Momentum?

Several factors are contributing to HDB Financial Services' positive price action post-listing:

-

Strong Parentage: As a subsidiary of HDFC Bank, the company benefits from a strong brand, robust governance, and risk management frameworks.

-

Healthy Financials: HDB Financial Services reported a 26% year-on-year increase in net profit to ₹1,961 crore in FY24, and its assets under management (AUM) grew 16% to ₹75,000 crore.

-

Improved Asset Quality: The gross non-performing asset (GNPA) ratio improved to 2.2% in FY24 from 3.7% in FY23, signaling prudent risk controls and recovery mechanisms.

-

Valuation Comfort: Many analysts believe that the derived valuation post-listing leaves some room for upside, especially if the company sustains its earnings momentum and improves return ratios.

Analysts’ Views: Hold With a Watchful Eye

Market experts are offering a cautious yet constructive outlook on HDB Financial Services.

"The listing was fair, but the stock is seeing post-listing traction due to expectations of strong long-term growth," said Vinit Bolinjkar, Head of Research at Ventura Securities. "It offers a unique play on consumer finance with the backing of HDFC Bank, which is a comfort factor for many investors."

Meanwhile, Jyoti Roy, DVP Equity Strategist at Angel One, recommends a ‘Hold’ rating: “At current levels, the stock appears fairly valued. However, future gains will depend on the pace of AUM growth, asset quality stability, and cost of funds.”

Market Context: NBFCs in Spotlight

The broader NBFC sector has been in favor over the past few quarters, driven by rising credit demand in retail and SME segments. With banks tightening lending norms, many NBFCs have expanded their market share in personal loans, used car financing, and business loans.

However, the regulatory environment is also evolving. The RBI has increased scrutiny of unsecured lending, and tighter capital adequacy norms are on the horizon. In this context, larger and better-governed NBFCs like HDB are expected to benefit.

"The RBI’s push for regulatory convergence between banks and NBFCs may favor stronger entities like HDB, which have robust risk frameworks," noted Shweta Daptardar, Senior Analyst at Elara Capital.

Peer Comparison and Valuation

HDB Financial Services currently trades at a Price-to-Book (P/B) ratio of around 2.4x, which is lower than Bajaj Finance (7.5x) but higher than some regional NBFCs. The company's Return on Equity (RoE) stands at 13.6%, with potential to rise as operating leverage kicks in and the company scales further.

Compared to LIC Housing Finance, Shriram Finance, and Muthoot Finance, HDB’s asset quality and cost of funds are better positioned due to its parentage, although its return ratios are currently more modest.

Investor Outlook: Buy on Dips or Wait and Watch?

For investors who received HDB Financial Services shares through the HDFC Bank demerger scheme, the current uptrend provides an opportunity to assess portfolio strategy.

-

Long-term Investors: Can hold the stock, as HDB is expected to benefit from India’s growing consumption and credit demand. Any major correction can be used to accumulate more.

-

Short-term Traders: Might consider booking partial profits given the sharp post-listing rally, especially if the broader market turns volatile.

-

New Investors: Should wait for some consolidation or dips, as fresh entry at current levels may offer limited short-term upside.

Risks to Watch

While the outlook appears promising, there are risks:

-

Rising interest rates could compress margins.

-

Increased competition in retail lending.

-

Any deterioration in asset quality, especially in unsecured loans, can weigh on performance.

-

Regulatory tightening from the RBI could slow expansion.

HDB Financial Services has managed a respectable stock market debut and sustained gains thereafter, buoyed by solid fundamentals, strong parentage, and improving operational metrics. While the stock may not be a screaming buy at current valuations, it remains a worthy contender for long-term portfolios seeking exposure to the NBFC growth story. Investors are advised to track quarterly performance, asset quality trends, and regulatory developments to make informed decisions.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0