Mutual fund investments of banks jump 91% YoY to Rs 1.19 lakh crore in March

Indian banks increased their mutual fund investments by 91% YoY to ₹1.19 lakh crore in March 2025, driven by liquidity optimization and favorable debt fund yields. Read detailed analysis and expert insights.

Banks Register Sharp Uptick in Mutual Fund Allocations

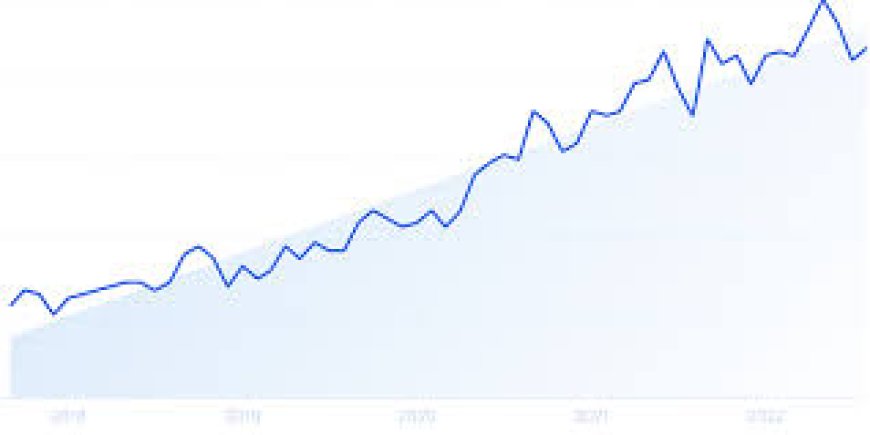

In a notable shift in financial strategy, Indian banks have significantly increased their investments in mutual funds, recording a sharp 91% year-on-year jump to ₹1.19 lakh crore in March 2025, according to the latest data from the Association of Mutual Funds in India (AMFI). This surge compares to ₹62,325 crore recorded during the same period last year.

The increase is attributed to a combination of factors including improved liquidity conditions, favorable interest rate expectations, and better yields offered by fixed-income mutual fund schemes, particularly liquid and short-duration funds.

Rising Liquidity and Regulatory Flexibility Drive Investments

Industry experts suggest that improved liquidity buffers and a recalibration of banks' treasury portfolios played a major role in this spike. Over the past fiscal year, the Reserve Bank of India (RBI) maintained a relatively accommodative stance while navigating inflationary pressures, resulting in a stable interest rate environment that made mutual fund instruments more attractive.

“Banks are recalibrating their short-term liquidity strategies,” said Rajiv Mehra, Fixed Income Analyst at Kotak Securities. “With greater flexibility in managing surplus funds, especially after TLTRO repayments and stable deposit flows, mutual funds have emerged as a convenient and low-risk parking space.”

Liquid and Debt Funds Lead the Pack

Data reveals that liquid funds and ultra-short-duration funds accounted for the majority of this inflow. These categories provide better risk-adjusted returns compared to traditional instruments like fixed deposits or inter-bank placements, especially over short durations.

Debt-oriented schemes attracted most of the bank allocations, with liquid funds alone witnessing a 70% YoY rise in bank investments. The higher AUM in such funds also reflects a systemic confidence in the short- to medium-term interest rate trajectory.

“Debt funds continue to offer competitive yields, with the added benefit of tax efficiency and daily liquidity,” noted Ritika Malhotra, Fund Manager at HDFC Mutual Fund. “Banks are not just looking at returns but also at the flexibility mutual funds offer in managing overnight and short-term surpluses.”

Regulatory Guardrails and Risk Assessment

While banks have the regulatory latitude to invest in mutual funds, the RBI mandates limits and stress-testing norms to mitigate concentration risk and liquidity mismatches. Most public sector and private banks have invested cautiously within the prescribed limits, with preference given to highly rated schemes.

“There’s a visible trend of risk-aware behavior,” stated Sanjay Tripathi, a senior banking consultant. “Banks are using mutual funds as a strategic extension of treasury management, not for return maximization but for liquidity optimization.”

Market Dynamics and the Broader Investment Climate

The increase in mutual fund investments by banks comes at a time when overall mutual fund industry assets under management (AUM) have crossed ₹56 lakh crore, reaching historic highs. Retail and institutional inflows have been robust, fueled by positive economic outlook, rising SIP (Systematic Investment Plan) numbers, and consistent equity market performance.

Moreover, with the expectation that the RBI may begin rate cuts in the second half of 2025 to stimulate growth amid slowing global demand, fixed-income instruments are likely to gain even more favor, potentially prompting further allocations by banks in the upcoming quarters.

Outlook for Investors and Industry

From an investor's standpoint, the significant inflow from banks into mutual funds adds a layer of institutional validation to the product class. It reaffirms mutual funds as a reliable investment avenue not just for individuals but also for sophisticated financial entities.

“This should boost retail investor confidence,” said Ashwini Batra, a financial advisor with over two decades of experience. “When banks park their funds in mutual schemes, especially debt and liquid funds, it reflects stability and trust in fund houses and their underlying asset quality.”

Analysts predict that the upward trend in bank participation is likely to sustain, albeit at a moderated pace, depending on macroeconomic variables and credit demand cycles.

The remarkable 91% YoY surge in mutual fund investments by banks, touching ₹1.19 lakh crore in March 2025, underscores a strategic evolution in how banks manage short-term funds. Backed by strong liquidity, favorable interest dynamics, and risk-managed fund offerings, mutual funds are increasingly becoming a core component of treasury operations.

This trend not only strengthens the mutual fund industry’s position in the financial ecosystem but also offers a positive signal to retail investors who often take cues from institutional behavior.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0