London shares edge lower as mining, bank stocks weigh

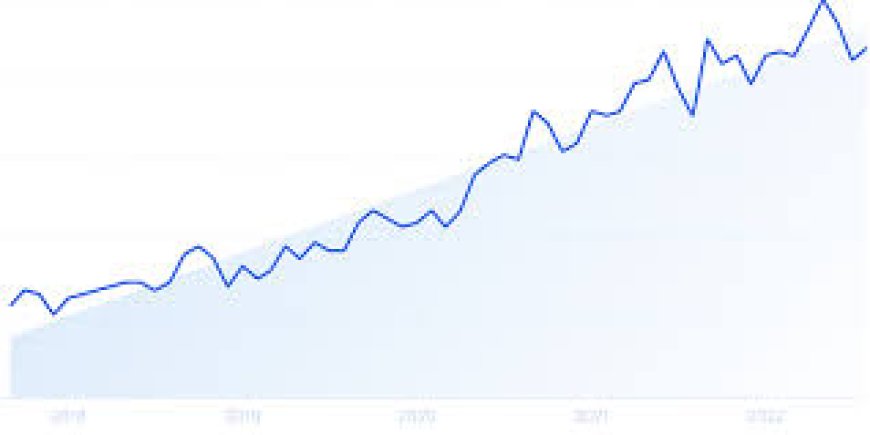

London shares edged lower on Tuesday, led by declines in mining and banking stocks. The FTSE 100 fell 0.4% amid weak metal prices and interest rate concerns.

FTSE 100 Slips Amid Sectoral Drag

The FTSE 100 declined by 0.4% to close at 8,195.36 points, reversing gains from the previous session. Mid-cap stocks on the FTSE 250 also posted a slight loss of 0.2%, weighed down by domestically focused financials and materials companies.

Heavyweight miners such as Rio Tinto, Anglo American, and Glencore were among the top losers, falling between 1.5% and 2.3%, as metal prices declined on renewed concerns about China’s industrial demand. The banking sector also saw selling, with Barclays, HSBC, and Lloyds Banking Group shedding between 0.6% and 1.1%.

Commodity Prices and China Concerns Pressure Miners

Base metal prices dropped on the London Metal Exchange, with copper and aluminium both sliding nearly 2% as investors remained wary of the strength of China’s post-pandemic recovery. Concerns over slowing construction activity and underwhelming manufacturing data released earlier in the week added to the gloom.

“China remains a critical demand engine for industrial metals,” noted Sophie Grant, senior commodities analyst at Westbourne Markets. “The latest data show persistent weakness in real estate and manufacturing, which are traditionally the heaviest consumers of copper and iron ore.”

Banks Face Yield Curve and Regulatory Pressures

UK bank stocks continued to face headwinds from a flatter yield curve, as expectations of interest rate cuts by the Bank of England (BoE) in the second half of 2025 have intensified. Analysts anticipate the central bank may reduce its base rate by 25 basis points as early as August, in response to cooling inflation and stagnating consumer spending.

“Banking margins are being squeezed as forward guidance shifts dovish,” said Elliot Morgan, head of equity research at Marlowe Capital. “Investors are starting to reprice for a lower-for-longer rate environment, which hits earnings potential for the major lenders.”

The BoE’s Monetary Policy Committee is set to meet next week, with investors closely watching for any shift in tone or inflation forecast revisions.

Global Backdrop Mixed

Elsewhere, global equity markets were mixed, with Wall Street opening higher on upbeat tech earnings while European bourses largely hovered near the flatline. Germany’s DAX gained 0.3%, while France’s CAC 40 lost 0.1%. The broader STOXX 600 index was little changed, as conflicting macro signals kept traders on edge.

In the U.S., the focus remains on upcoming labor market data and the Federal Reserve’s next move. The Fed is widely expected to keep rates steady at its June meeting, but any surprise in employment or inflation metrics could change the calculus.

Sterling Holds Firm; Bond Yields Ease

The British pound was steady against the dollar at $1.2740, supported by resilient services PMI figures released earlier in the day. Meanwhile, UK 10-year gilt yields declined marginally to 4.06%, reflecting bond traders' bets on a near-term rate cut.

Investor Outlook: Cautiously Defensive

Market participants are increasingly adopting a defensive approach, rotating into more stable, dividend-paying sectors like consumer staples and utilities, amid macroeconomic uncertainties and declining risk appetite.

“The market’s bias is shifting toward preservation of capital over high beta plays,” observed Karen Hall, investment strategist at Eton Ridge Wealth. “With potential rate cuts looming and weak global demand, cyclicals like mining and banking are naturally losing momentum.”

Despite the day’s setback, analysts caution against reading too much into short-term fluctuations, noting that long-term fundamentals remain intact for several UK-listed multinationals, particularly those with diversified global revenue streams.

Conclusion

London’s equity markets ended slightly lower on Tuesday, as softness in commodity prices and rate-sensitive sectors such as banks weighed on the FTSE 100. With central bank decisions and global macro signals in focus, investors appear to be recalibrating portfolios toward stability and lower volatility in the second half of 2025.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0