Europe and China Seek Trade Alliance Amid Growing Tensions — Auto Sector Faces Disruption

Europe and China aim to strengthen trade ties, but underlying tensions in the EV and tech sectors could reshape global trade flows. Explore the rising challenges and opportunities as two major economies navigate strategic realignments.

Europe and China Want to Be Trade Allies. This Sector Could Be Upended

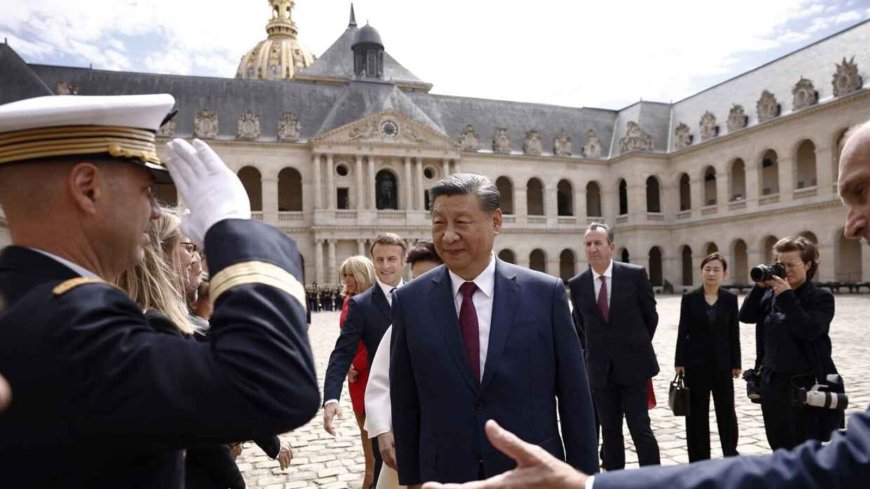

In an increasingly fractured global economy, where old alliances are being tested and new blocs are taking shape, Europe and China are trying to reshape their trade relationship into one of strategic cooperation. But beneath the warm diplomatic gestures lies a deep undercurrent of industrial rivalry — especially in a sector that defines innovation, employment, and geopolitical influence: the automotive industry.

As both powers seek economic stability amid global uncertainty, a potential alignment between Europe and China is sparking debate — and the stakes are high. Nowhere is this friction more visible than in the electric vehicle (EV) market, a domain where China's aggressive expansion is being met with rising European apprehension.

Why Europe and China Need Each Other — At Least Economically

Despite their ideological differences and past frictions over human rights, technology transfer, and supply chain dependencies, economic pragmatism continues to drive the EU-China relationship. Europe is grappling with slow growth, energy price volatility, and a heavy reliance on external markets. China, on the other hand, faces falling exports to the West, declining property sector performance, and a weakening yuan.

A renewed trade partnership offers both sides a much-needed economic lever:

-

Europe seeks to secure its access to Chinese markets for its luxury goods, machinery, and financial services.

-

China wants to protect its status as the world’s factory and expand its global export dominance, especially in green technology.

This fragile cooperation was recently on display when top EU trade officials visited Beijing to reiterate their commitment to trade dialogue, despite several pending investigations into alleged Chinese industrial subsidies.

The Flashpoint: Electric Vehicles and the Auto Sector

While cooperation seems desirable, the automotive sector — particularly electric vehicles — has emerged as the core battleground in this relationship.

China’s EV Juggernaut:

Over the last decade, China has aggressively built a global EV powerhouse. Backed by state subsidies, favorable policies, and integrated supply chains, Chinese EV makers like BYD, XPeng, and NIO have expanded rapidly across Europe.

-

China exported over 1.5 million EVs globally in 2024, with nearly 30% destined for European markets.

-

Brands like MG (owned by SAIC) and BYD are gaining traction in countries like Germany, France, and the Netherlands.

This success, however, is triggering a protectionist backlash in Europe. The European Commission launched an anti-subsidy investigation into Chinese EV imports in late 2023 — a clear sign of rising discomfort with the speed and scale of China’s EV expansion.

“We want fair competition, not a race to the bottom fuelled by state support,” said EU Competition Chief Margrethe Vestager.

European Automakers Feel the Heat

The implications for European carmakers are profound. Giants like Volkswagen, Stellantis, Renault, and BMW face a dual challenge:

-

Competing with cheap, well-equipped Chinese EVs on price.

-

Keeping up with the fast pace of innovation and battery tech emerging from China.

Many EU firms rely on Chinese partnerships or supply chains for battery cells, rare earth materials, and semiconductors. Even as Europe talks about strategic autonomy, it remains deeply intertwined with Chinese production lines.

🇩🇪 Germany’s Dilemma:

Germany, Europe’s largest economy and automotive hub, is particularly exposed. It depends on China for:

-

Over 40% of its EV battery imports

-

A significant chunk of its luxury car sales (BMW, Mercedes, and Audi sell more units in China than in Europe)

Thus, Berlin is caught between defending its industrial base and preserving bilateral ties with China — a tightrope act that could redefine Germany’s economic future.

A Sector That Could Be Upended: The EV Value Chain

The rise of Chinese EV exports poses a threat not just to finished car sales but also to the entire value chain, including:

-

Battery Manufacturing

-

Semiconductor Supply

-

Autonomous Driving Tech

-

Critical Minerals (lithium, cobalt, nickel)

China controls more than 70% of global battery production and owns or finances key mining assets in Africa, South America, and Southeast Asia. It has already weaponized this control subtly through pricing and export restrictions.

Europe’s lack of upstream control over critical resources makes it vulnerable — and any escalation in trade friction could upend its path to electrification and decarbonization.

Is Strategic Decoupling Even Possible?

Many European leaders talk about “de-risking” rather than “decoupling” — a term popularized by European Commission President Ursula von der Leyen. But the ground reality is complex.

China is deeply embedded in Europe's green transition:

-

Chinese firms provide solar panels, wind turbines, EV components, and batteries.

-

Europe lacks the domestic capacity to match China’s manufacturing scale.

Any sudden disengagement could set back Europe’s green goals and expose it to higher costs and slower adoption of clean technologies.

At the same time, failing to protect local industry from unfair competition may lead to factory closures, job losses, and populist backlash — particularly in regions already suffering from industrial decline.

Beyond Autos: Tech and AI on the Radar

The battle doesn’t stop at EVs. Both Europe and China are quietly escalating their rivalry in semiconductors, AI, and digital infrastructure. The EU’s Digital Markets Act aims to regulate Big Tech, while China is pushing for greater sovereignty in its own internet ecosystem.

Meanwhile, European telecom equipment makers like Ericsson and Nokia are losing market share to Chinese players like Huawei in developing nations — despite bans on Chinese equipment within the EU.

Expect future trade negotiations to also include clauses on:

-

Data localization

-

AI ethics and safety

-

Cross-border digital payments

-

Intellectual property enforcement

Investor Watch: Who Wins or Loses in a Trade Reboot?

Potential Winners:

-

European battery startups (e.g., Northvolt, ACC)

-

Raw material exporters (Africa, Australia, South America)

-

Logistics & port infrastructure firms (handling Asia-Europe routes)

-

Chinese budget EV makers (if trade barriers stay low)

Potential Losers:

-

Legacy European carmakers slow to electrify

-

Component suppliers dependent on open borders

-

Consumers, if protectionism drives up prices

-

Green energy goals, if supply chains fracture

Conclusion: Allies or Adversaries in the Making?

As the world moves toward green tech and digital infrastructure, the EU-China relationship will be defined not just by diplomacy but by industrial strategy. Both powers know they need each other — yet both are wary of the long-term risks of dependency.

The auto sector is merely the first of many frontlines. Whether this relationship evolves into a balanced partnership or breaks down into another battleground of economic nationalism will depend on how both sides manage competition, fairness, and future readiness.

For now, Europe and China remain uneasy allies in a shifting trade landscape — with the fate of global EV leadership hanging in the balance.

FAQs — EU-China Trade & Automotive Tensions

Q1. Why is the EU investigating Chinese EVs?

To assess whether Chinese automakers benefit from unfair state subsidies that hurt local competition.

Q2. Which Chinese brands are entering Europe?

BYD, MG (SAIC), XPeng, NIO, among others.

Q3. Are European carmakers producing in China?

Yes. VW, BMW, and Mercedes have long-standing joint ventures with Chinese firms.

Q4. What’s at stake for Europe?

Jobs, industrial competitiveness, and green transition goals — particularly in the EV and battery sectors.

Q5. Will tariffs be imposed on Chinese EVs?

Possibly. The EU anti-subsidy probe could result in additional tariffs, though negotiations are ongoing.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0